Quiz

Beginners’ guide to technical analysis

Beginners’ guide to technical analysis

BECCA CATTLIN, ig.comTechnical analysis is a method of predicting the future direction of a market’s price by studying historical chart patterns and formations.

Understanding technical analysis

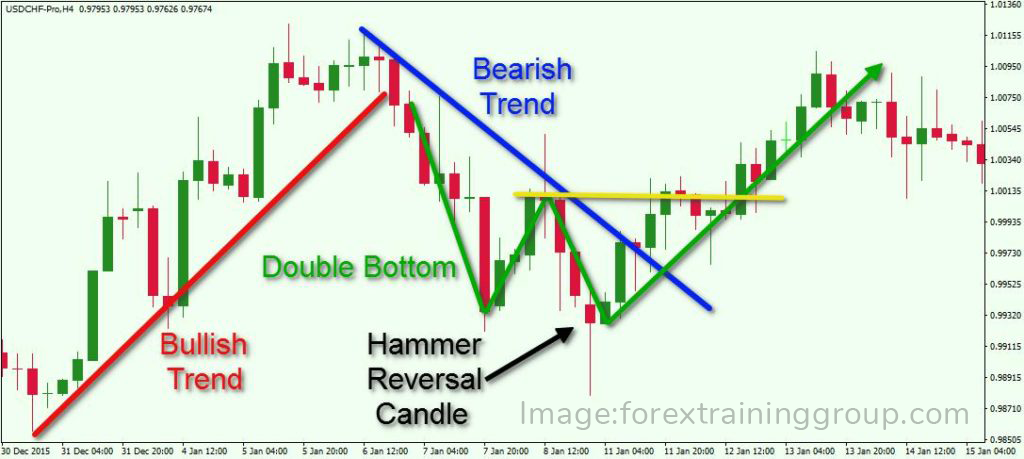

There are a range of ways that traders can perform technical analysis, but most will focus on using historical price charts overlaid with technical indicators or oscillators. The aim of technical analysis is to identify recognizable patterns that will help traders find the right time and price point at which to enter and exit the market.

There are many different indicators that technical analysts will use on charts. Some popular technical analysis strategies will utilize moving averages, Fibonacci retracements and Bollinger bands in order to identify price points for entering and exiting trades. But the indicators used will vary from individual to individual, depending on their trading style, the market they’re trading and the timeframe they are looking at.

It is common for technical analysts to test how their strategy would perform – before risking any actual capital – by applying it to a market’s previous price movements. This is called back-testing. It involves taking a chunk of real data from a selection of markets and running a strategy against it. If the back-testing works, traders and analysts will develop the confidence to use the technical analysis as the basis for entering live positions.

In fact, some traders become so confident in how their strategy will perform that they decide to automate it. Automating a technical analysis strategy involves setting up a series of algorithms that can execute trades with minimal human involvement.

.png)

Key assumptions of technical analysis

Broadly speaking technical analysis is based on the key assumptions that:

The charts tell a story. Proponents of technical analysis believe they can predict future movements based on historic prices. However, it is generally advisable to combine fundamental and technical analysis to ensure you understand the market fully before you place a trade

Market prices move in trends. According to Dow theory there are three trend timeframes. These are primary movement, which can be a year to several years, secondary reaction, which is anything from ten days to a year, and minor movement, which can be seconds to days

Historical trends repeat themselves. Analysts believe that price patterns will tend to repeat themselves in the future. So, they’ll look at market’s previous price movements, and use those to decide when to open and close trades to maximize their profits

How is technical analysis used?

Technical analysis is used for both short and long-term trading. A long-term trend investor might use technical indicators to decide when to buy shares for their portfolio, while a short-term day trader could use them to identify quick opportunities for profit. Timing is a crucial part of successful trading, and technical analysis can help you time your trades to maximize profits and minimize losses.

Technical analysis can be used on almost any market – all you need is a price chart and access to some technical indicators. So, whether you want to trade stocks, indices, forex or cryptocurrencies, technical analysis can be of use.

Technical analysis vs fundamental analysis: an example.

Let’s say a fundamental and a technical analyst were both considering trading Apple shares. A fundamental analyst might examine Apple’s recent earnings reports, how the technology sector is performing, and the health of the economy as a whole before deciding how much they think Apple shares are worth.

While a technical analyst would disregard all of that information and pay attention solely to Apple’s chart. They would use technical indicators to find patterns that would give an insight into where Apple shares have previously been, and use that data to guide assumptions about where the stock price is headed next. They would then trade accordingly.

At first, technical analysis might look a lot simpler than fundamental analysis. After all, you only have to examine a market’s chart instead of poring through news, economic reports and earnings releases. But a successful technical trader might utilize a huge range of indicators – and back-test their strategy to make sure that it’s fit for purpose – before they trade. So, it certainly isn’t the easier option.

Having said that, most traders won’t stick to pure technical or fundamental analysis – they’ll employ a mix of the two to ensure they have a fully balanced view. So, you could use

fundamental analysis to pick the market you want to trade, and then use technical analysis to decide when you should open your position.

Limitations of technical analysis

Although technical analysis is widely used, the methodology does have its limitations. For example:

Technical analysis can be subjective. Although indicators may show two traders the same signal, they could interpret the results in different ways.

It can create a self-fulfilling prophecy. If enough people trade using the same pattern, it will actually force the prediction to occur. While this can work in your favor, it can also make it more difficult to execute your trade if everyone is executing the exact same orders Technical analysis is not 100% accurate. There are always likely to be exceptions to the rule, which could be extremely dangerous. Unexpected movements can cause large price swings as technical traders rush to exit their positions.

It ignores the underlying fundamentals. By not looking at other factors that can move the market price, technical analysis provides a restricted view of the market. Although it can provide useful entry and exit points, assuming things go to plan, any sudden news announcements or company reports can cause volatility.

It is important to be aware of any potential drawbacks of your strategy and take any steps to prevent them causing you unnecessary losses.

Go To Source

Go To Source

DISCLAIMER

For information purposes only; not intended as financial advice